Will you be obtaining a personal bank loan? Before signing with the dotted range, you must understand precisely what particular contract youre entering towards. That key part of this process try accepting one to people approved personal loan provide includes specific standards connected. We are going to establish a great conditionally recognized unsecured loan and you can just what borrowers you would like understand prior to taking away eg financing. Having a better understanding of this info, you possibly can make a lot more advised behavior about your earnings about coming.

During the Town Money, we offer several different types of personal loans. For each and every mortgage comes with a unique group of conditions and terms that must definitely be met through to the money is put out into borrower. If perhaps a certain financing doesn’t satisfy each of these types of requirements, it could nevertheless be recognized on the a conditional foundation. This means that particular fine print or transform need to basic be produced so that the borrowed funds to become finalized. By having a much better understanding of this step, you might make certain all the details are located in acquisition before acknowledging any financing render.

Conditional recognition for a financial loan occurs when a loan provider keeps initial looked at debt data files. Just like your credit file, income or any other points, and you will thinks that you satisfy its very first conditions. It doesn’t mean the loan was totally recognized. It indicates there could be other requirements brand new borrower must fulfil before its closed. During the conditional financing approval, we might you would like a great deal more economic pointers on borrower. Eg extra bank statements or details about one home assets.

New debtor have to fulfil the conditional criteria. This will know if capable just do it then for the financing adviser and finally discover complete recognition. Being approved conditionally gives the debtor an indicator that they are likely to be acknowledged to the loan. This may in addition to provide us with more time to arrange each of the desired paperwork, mention repayment possibilities and you can finalize the brand new agreement. In the long run, that have conditional acceptance enables you to know that the loan was almost complete which we believe that you can pay back what has been borrowed.

How can Pre Recognized Signature loans Really works?

Pre acknowledged personal loans are loans Bay Minette AL a kind of consumer loan you to is out there to individuals which have a great pre-licensed borrowing limit. We provide individuals a convenient and flexible cure for pull out more loans. Furthermore, it is without worrying concerning more papers and you will challenge related having a routine application for the loan. The procedure for acquiring good pre recognized unsecured loan pertains to examining your credit score, knowing the small print of one’s financing, along with submitting virtually any associated papers required by bank.

Immediately following recognized, you’ll discovered your fund in both complete or with the an enthusiastic instalment bundle, depending on the fresh new lender’s policy. You will need to remember that pre approved personal loans get carry large interest rates than just conventional secured finance. It is using their straight down standards for recognition. But not, pre-recognized unsecured loans would be a great solution for these appearing to possess quick funding choice. This type of financing normally very theraputic for people with poor credit, as they may find it more straightforward to qualify than just which have an excellent conventional financing.

What types of Consumer loan Pre Approval Are there?

While provided taking out fully a consumer loan, it may be confusing to decide if you would like full approval or conditionally acknowledged. You will find two types of pre-acceptance for personal loans. Knowing their differences can help you create a whole lot more told choices in the the money you owe.

Conditional Approval to have Existing Users

Conditional acceptance to own current consumers will be a very good way to help you safer financial help. There is no doubt that credit score and you will money account are felt whenever recognition is being calculated. We shall guarantee that a keen applicant’s income and you can personal debt levels see their centered criteria before authorizing a loan. Whether or not conditional recognition cannot ensure the approval of a loan, it has got guarantee the pre-acceptance process demands smaller work and you may data files than simply should you have applied to your.

Less than perfect credit Pre Approval

Finding a less than perfect credit pre-acceptance off a loan provider should be a very important window of opportunity for the individuals that have reduced-than-finest borrowing from the bank histories. It is a bona fide possible opportunity to located unconditional recognition to own an effective loan and have the conditions which can be best suitable for the financial situation. From this process, lenders usually glance at your financial allowance and you will current employment status. Permits you to get way more favourable options just before latest mortgage acceptance. Which have bad credit pre-acceptance, you could end up being secure when you look at the comprehending that suitable mortgage bundle is actually started to.

Simple tips to Make an application for good Pre Accepted Mortgage?

Trying to get a good pre-accepted financing is an easy techniques. All you need to would is actually provide the vital information in order to your financial and you may sign up for the loan of your choice. After you have agreed upon the brand new terms and conditions, your documents was vigilantly assessed and canned. In that way, you could take advantage of lower pricing, extended cost words, and versatile percentage choices. Whatsoever needed information is actually verified, the money could well be in a fast manner so you might security any type of bills you’ve got.

Do you know the Eligibility Conditions In order to become Pre Accepted?

To become financing accepted, you ought to meet particular qualifications criteria of your own secure mortgage manager. Generally, loan providers evaluate numerous situations when evaluating potential individuals. Below are a few quite common:

- A copy of your ID

- An initial application having info like your address and contact number

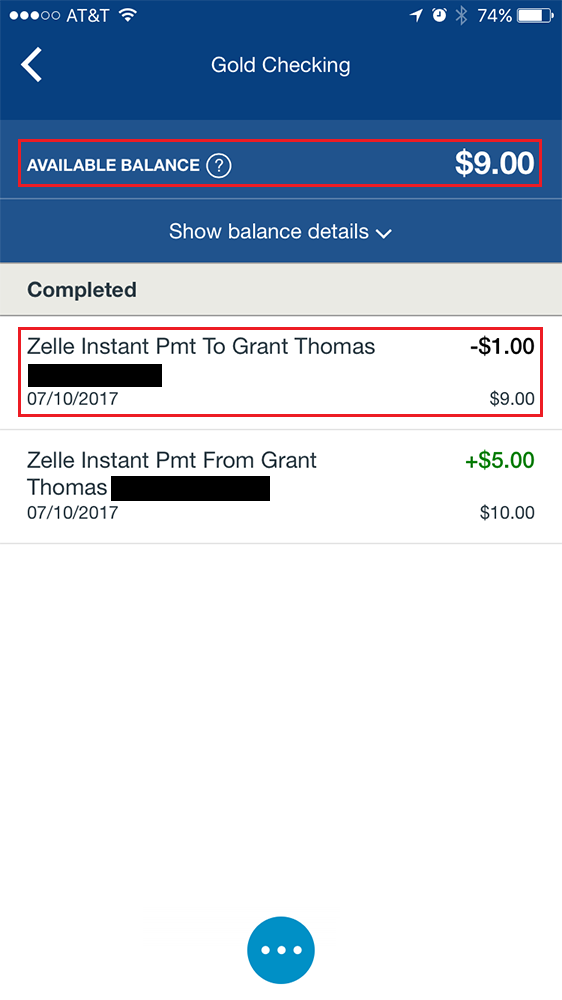

- 90-big date reputation for lender transactions

- Proof of your earnings (often earnings otherwise Centrelink pros)

Can a loan Be Rejected Immediately after Conditional Approval?

Sure! Funds is generally declined even after conditional acceptance. Which normally occurs when the brand new borrower has didn’t upload brand new necessary records or if perhaps it fall short away from appointment the brand new being qualified requirements lay by underwriter. Individuals need just remember that , compliance with mortgage requirements and you can adherence to help you all related rules needs due to their money as accepted. Failure to accomplish this can cause financing rejection.

How to proceed when your Conditionally Recognized Mortgage Cannot Discover Last Approval?

If for example the mortgage don’t discover finally acceptance even with meeting this new put conditions, you may want to find almost every other monetary choice. You’re capable of getting choice lenders who are a lot more versatile and you may happy to work with you into the mortgage terminology or rates you to most readily useful suit your budget. Alternatively, it is always best if you contact credit counsellors and you will financial advisors who’ll let assist you into better action to take.