Your own personal affairs and you can capability to repay the mortgage will determine if or not you want to proceed that have a link mortgage or a great HELOC.

A good HELOC, simultaneously, now offers longer conditions for fees otherwise trust you’re going to be able to pay-off the loan completely quickly. Do your research before applying since the some other loan providers can give varying selection and you may standards.

you will have to estimate coming can cost you that will be obtain. Brand new link financing, by way of example, will assist in offering the 20% down-payment need for your home.

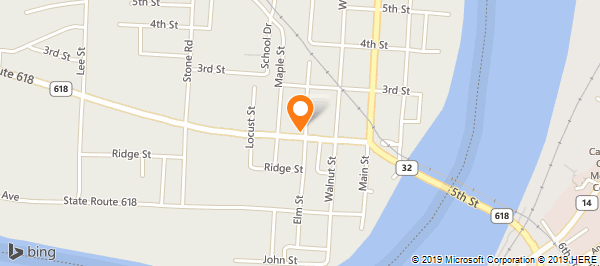

Whichever choice you create, if or not a link financing or a great HELOC, Compass Financial is obtainable so you can make best selection

But not, when you yourself have some funds created for your down payment but need pool a little extra loans, a HELOC might possibly be a far greater solution. The discounts and you will a smaller sized loan helps you arise with that 20% down-payment.

HELOC will be a faster, inexpensive solutions out from the two, especially if you features a number of guarantee of your house.

Whilst financial usually commercially allows you to borrow against any investment you possess, together with your 401(k), the fresh HELOC could possibly be the greatest or introduce the fresh new smallest roadway when you yourself have sufficient equity.

The latest HELOC is the ideal monetary solutions as the attention rates toward a connection mortgage home loan would be more than they might be with the a routine home loan. If you’re a connection financing normally a very important unit having short-term money, it could be higher priced overall, and there tends to be extra will set you back one start around dos-cuatro %.

Make right choices with Compass Mortgage

Our very own experienced and you may enchanting group is able to help you get pre-acknowledged, purchase a separate household otherwise tap into your current home’s equity.

Looking for to increase, otherwise move off your downpayment try associated with the brand new equity in your newest domestic? Link Financing is an issue nowadays with catalog becoming therefore rigorous.

Buy Connection Money: are utilized when a borrower would like to buy a different assets ahead online installment loans instant approval Hawai of promoting the present assets. The loan will bring short-term financing to purchase get till the product sales of the current property is closed. Because profit is done, brand new borrower can pay off the bridge financing.

On New Mortgage we’re not a lender, the audience is independent mortgage brokers that work to you personally, people, and we also have very several options to possess link finance together with which great 0% interest true bridge mortgage.

Really once we get you pre-approved to purchase your new house, i complete several variables from the link loan so you’re able to observe much currency we can sign up for of your latest house. You might use doing 80% of your value of your residence while the interest rate to own the mortgage is actually 0%. This means if you find yourself within the escrow, purchasing your brand new home, this financing would not apply to your debt-to-income ratio.

Very, why don’t we only use a typical example of property worth 1M. and you can allows say you may have a first home loan off five-hundred,000. This will free up $three hundred,000 from inside the dollars to utilize since the an advance payment in to the your brand-new domestic.

Up coming when we personal escrow on your own brand new home, you really have ninety days to sell the current home. Having inventory getting therefore rigorous during the California, which is plenty of time to offer you domestic during the a limitation value.

Remember, you won’t feel life there, to stage the property and extremely obtain it within their top sales really worth without the be concerned from promoting very first and you will renting, or moving twice an such like.